Capital Gains¶

This chapter will present some of the techniques used to keep track of the unrealized and realized gains and losses, better known as capital gains and losses.

Basic Concepts¶

This chapter will present some of the techniques used to keep track of the unrealized and realized gains and losses, better known as capital gains and losses.

Certain resellable assets can change value over time, such as stocks, bonds, houses, or cars. Some assets (eg: a stock) could increase in value, some (eg: a car) could decrease in value. It is important to be able to track some of these time-dependent asset valuations, this chapter will show you how.

Probably everything you own will increase or decrease in value over time. So, the question is for which of these assets should you track this changing value? The simple answer is that you only need to track this for items which could be sold for cash in the future or which relate to taxation.

Consumable and disposable items (eg: food, gas for your car, or printer paper) are obviously not involved. Thus, even though the new clothes you recently bought will certainly depreciate, you would not want to track this depreciation since you have no intention of reselling the clothes and there is no tax implications to the depreciation on clothing. So, for this example, the purchase of new clothes should be recorded as a pure expense… you spent the money, and it is gone.

Asset appreciation occurs when something you own increases in value over time. When you own an asset which has increased in value, the difference between the original purchase price and the new value is known as unrealized gains. When you sell the asset, the profit you earn is known as realized gains or capital gains. An example of an asset from which you could have unrealized gains, and eventually capital gains, is stock in a publicly traded company.

Estimating Valuation¶

As mentioned in the introduction to this chapter, capital gains are the profits received from the sale of an asset. This section will describe how to record capital gains in GnuCash.

The accounting methods for handling asset appreciation differs somewhat from depreciation because typically you are only concerned with the moment you sell the asset and realize the capital gains. This is opposed to the continuous nature of tracking depreciation. Capital gains are an important subject in the world of taxation, because governments tend to be quite interested in taxing capital gains in one manner or another.

Note

As always, there are exceptions. If you hold a bond that pays all of its interest at maturity, tax authorities often require that you recognize interest each year, and refuse this to be treated as a capital gain. Consult the appropriate tax codes to determine the preferred treatment for each type of asset you have which may be affected by capital gains taxes.

Estimating the increasing value of assets is generally not simple, because often it is difficult to know its exact value until the moment it is sold.

Securities traded daily on open markets such as stock exchanges are possibly the easiest type of asset to predict the value of, and selling the asset at market prices may be as simple as calling a broker and issuing a Market Order. On the other hand, estimating the value of a house is more difficult. Homes are sold less often than stocks, and the sales tend to involve expending considerable effort and negotiations, which means that estimates are likely to be less precise. Similarly, selling a used automobile involves a negotiation process that makes pricing a bit less predictable.

Values of collectible objects such as jewelry, works of art, baseball cards, and “Beanie Babies” are even harder to estimate. The markets for such objects are much less open than the securities markets and less open than the housing market. Worse still are one-of-a-kind assets. Factories often contain presses and dies customized to build a very specific product that cost tens or hundreds of thousands of dollars; this equipment may be worthless outside of that very specific context. In such cases, several conflicting values might be attached to the asset, none of them unambiguously correct.

The general rule of thumb in accounting for estimating unrealized gains (or loses) is that you should only revalue assets such as stocks which are readily sellable and for which there are very good estimates of the value. For all other assets, it is better to simply wait until you sell them, at which time you can exactly determine the capital gains. Of course, there is no hard rule on this, and in fact different accountants may prefer to do this differently.

Account Setup¶

As with most accounting practices, there are a number of different ways to setup capital gains accounts. We will present here a general method which should be flexible enough to handle most situations. The first account you will need is an Asset Cost account (GnuCash account type Asset), which is simply a place where you record the original purchase of the asset. Usually this purchase is accomplished by a transaction from your bank account.

In order to keep track of the appreciation of the asset, you will need three accounts. The first is an Unrealized Gains asset account in which to collect the sum of all of the appreciation amounts. The Unrealized Gains asset account is balanced by a Unrealized Gains income account, in which all periodic appreciation income is recorded. Finally, another income account is necessary, called a Realized Gains in which you record the actual capital gains upon selling the asset.

Below is a generic account hierarchy for tracking the appreciation of 2 assets, ITEM1 and ITEM2. The Assets:Fixed Assets:ITEM1:Cost accounts are balanced by the Assets:Current Assets:Savings Account account, the Assets:Fixed Assets:ITEM1:Unrealized Gains accounts are balanced by the Income:Unrealized Gains account (similar for ITEM2).

-Assets

-Current Assets

-Savings Account

-Fixed Assets

-ITEM1

-Cost

-Unrealized Gain

-ITEM2

-Cost

-Unrealized Gain

-Income

-Realized Gains

-Unrealized Gains

Example¶

Let’s suppose you buy an asset expected to increase in value, say a Degas painting, and want to track this. (The insurance company will care about this, even if nobody else does.)

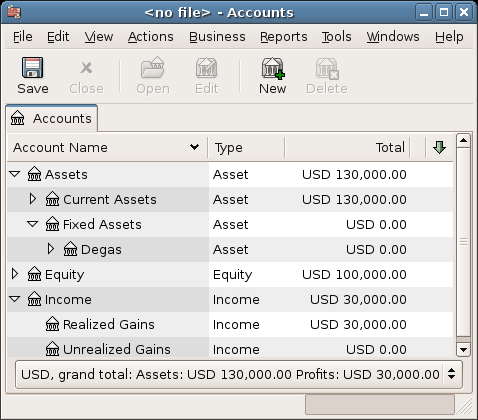

Start with an account hierarchy similar to that shown in Account Setup, but replace “ITEM1” with “Degas” and you can remove the “ITEM2” accounts. We will assume that the Degas painting had an initial value of one hundred thousand dollars. Begin by giving your self $100,000 in the bank and then transferring that from your bank account to your Assets:Fixed Assets:Degas:Cost account (the asset purchase transaction). You should now have a main account window which appears like this:

Unrealized Gains¶

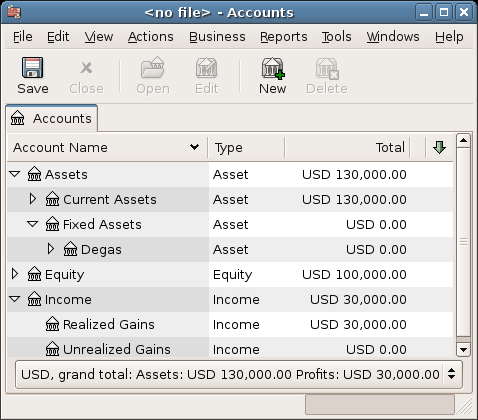

A month later, you have reason to suspect that the value of your painting has increased by $10,000 (an unrealized gain). In order to record this you transfer $10,000 from your Accrued Gains income account (Income:Unrealized Gains) to your asset Unrealized Gains account (Assets:Fixed Assets:Degas:Unrealized Gain). Your main window will resemble this:

Selling¶

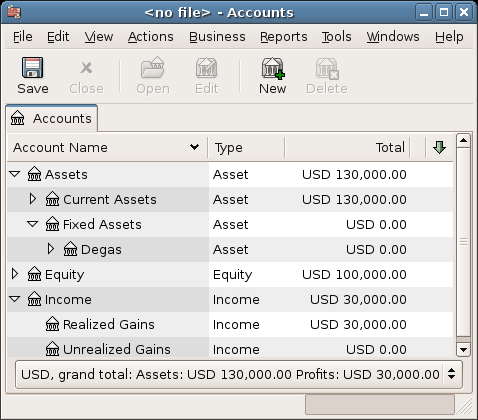

Let’s suppose another month later prices for Degas paintings have gone up some more, in this case about $20,000, you estimate. You duly record the $20,000 as an unrealized income like above, then decide to sell the painting.

Three possibilities arise. You may have accurately estimated the unrealized gain, underestimated the unrealized gain, or overestimated the unrealized gain.

Accurate estimation of unrealized gain.

Your optimistic estimate of the painting’s value was correct. First you must record that the profits made are now realized gains, not unrealized gains. Do this by transferring the income from the Income:Unrealized Gains to the Income:Realized Gains account.

Secondly, you must credit your bank account with the selling price of the painting. This money comes directly from your Assets:Fixed Assets:Degas sub-accounts. Transfer the full Assets:Fixed Assets:Degas:Cost value into Assets:Current Assets:Savings Account, and the full Assets:Fixed Assets:Degas:Unrealized Gain into Assets:Current Assets:Savings Account.

These transactions should now appear as follows:

Estimation

Account

Transfer to

Transaction Amount

Account Total

Inc ome:Unrealized Gains

I ncome:Realized Gains

$30,000

$0

Assets:Fixed Ass ets:Degas:Cost

Assets:Current Assets:Savings Account

$100,000

$0

Assets:Fixed Assets:De gas:Unrealized Gains

Assets:Current Assets:Savings Account

$30,000

$0

This leaves the Assets:Current Assets:Savings Account account with a total of $130000 and Income:Realized Gains with a total of $30000.

Under estimation of unrealized gain.

You were over-optimistic about the value of the painting. Instead of the $130000 you thought the painting was worth you are only offered $120000. But you still decide to sell, because you value $120000 more than you value the painting. The numbers change a little bit, but not too dramatically.

The transactions should now appear as follows (observe the last transaction which balances the Unrealized Gains accounts):

Underestimation

Account

Transfer to

Transaction Amount

Account Total

Inc ome:Unrealized Gains

I ncome:Realized Gains

$20,000

$10,000

Assets:Fixed Ass ets:Degas:Cost

Assets:Current Assets:Savings Account

$100,000

$0

Assets:Fixed Assets:De gas:Unrealized Gains

Assets:Current Assets:Savings Account

$20,000

$10,000

Assets:Fixed Assets:De gas:Unrealized Gains

Inc ome:Unrealized Gains

$10,000

$0

This leaves the Assets:Current Assets:Savings Account account with a total of $120000 and Income:Realized Gains with a total of $20000.

Over estimation of unrealized gain.

You manage to sell your painting for more than you thought in your wildest dreams ($150,000). The extra value is, again, recorded as a gain, i.e. an income.

The transactions should now appear as follows (observe the last transaction which balances the Unrealized Gains accounts):

Overestimation

Account

Transfer to

Transaction Amount

Account Total

Inc ome:Unrealized Gains

I ncome:Realized Gains

$50,000

$-20,000

Assets:Fixed Ass ets:Degas:Cost

Assets:Current Assets:Savings Account

$100,000

$0

Assets:Fixed Assets:De gas:Unrealized Gains

Assets:Current Assets:Savings Account

$50,000

$-20,000

Inc ome:Unrealized Gains

Assets:Fixed Assets:De gas:Unrealized Gains

$20,000

$0

This leaves the Assets:Current Assets:Savings Account account with a total of $150,000 and Income:Realized Gains with a total of $50,000.

Taxation¶

Taxation policies vary considerably between countries, so it is virtually impossible to say anything that will be universally useful. However, it is common for income generated by capital gains to not be subject to taxation until the date that the asset is actually sold, and sometimes not even then. North American home owners usually find that when they sell personal residences, capital gains that occur are exempt from taxation. It appears that other countries treat sale of homes differently, taxing people on such gains. German authorities, for example, tax those gains only if you owned the property for less than ten years.

Chris Browne has a story from his professional tax preparation days where a family sold a farm, and expected a considerable tax bill that turned out to be virtually nil due to having owned the property before 1971 (wherein lies a critical “Valuation Day” date in Canada) and due to it being a dairy farm, with some really peculiar resulting deductions. The point of this story is that while the presentation here is fairly simple, taxation often gets terribly complicated…