The Basics¶

This chapter will introduce some of the basics of using GnuCash. It is recommended that you read through this chapter, before starting to do any real work with GnuCash. Next chapters will begin to show you hands on examples.

Accounting Concepts¶

GnuCash is easy enough to use that you do not need to have a complete understanding of accounting principles to find it useful. However, you will find that some basic accounting knowledge will prove to be invaluable as GnuCash was designed using these principles as a template. It is highly recommended that you understand this section of the guide before proceeding.

The 5 Basic Accounts¶

Basic accounting rules group all finance related things into 5 fundamental types of “accounts”. That is, everything that accounting deals with can be placed into one of these 5 accounts:

- Assets

Things you own

- Liabilities

Things you owe

- Equity

Overall net worth

- Income

Increases the value of your accounts

- Expenses

Decreases the value of your accounts

It is clear that it is possible to categorize your financial world into these 5 groups. For example, the cash in your bank account is an asset, your mortgage is a liability, your paycheck is income, and the cost of dinner last night is an expense.

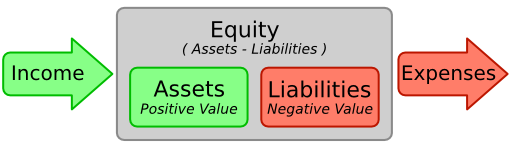

The Accounting Equation¶

With the 5 basic accounts defined, what is the relationship between them? How does one type of account affect the others? Firstly, equity is defined by assets and liability. That is, your net worth is calculated by subtracting your liabilities from your assets:

Furthermore, you can increase your equity through income, and decrease equity through expenses. This makes sense of course, when you receive a paycheck you become “richer” and when you pay for dinner you become “poorer”. This is expressed mathematically in what is known as the Accounting Equation:

This equation must always be balanced, a condition that can only be satisfied if you enter values to multiple accounts. For example: if you receive money in the form of income you must see an equal increase in your assets. As another example, you could have an increase in assets if you have a parallel increase in liabilities.

The basic accounts relationships¶

Debits and Credits¶

The use of debits and credits in accounting and their effect on accounts of different types is often confusing when first encountered in acccounting. The accounting equation introduced above is the key to understanding which accounts types are debited or credited and when. First of all we need to rearrange the expanded form a little bit with Assets on the left hand side of the equal sign and transposing any account type with a negative sign to the other side to obtain:

With the accounting equation in this form, the accounts on the left hand side of the equal sign are known as debit balance accounts in accounting practice, that is the normal positive balance for these accounts is increased by debit entries to accounts of these types. Conversely credit entries to accounts of these types will decrease the balance of accounts of these types.

Similarly, the account types on the right hand side of the equal sign are known as credit balance accounts, that is the normal positive balance for these account types is increased by credit entries to the accounts of these types. Again debit entries to accounts of these types will reduce the balance in the account.

balance of accounts of the 5 account types

Account Type

Effect on Account Balance

Assets

Increase

Decrease

Expenses

Liabilities

Decrease

Increase

Equity

Income

Double Entry¶

The accounting equation is the very heart of a double entry accounting system. For every change in value of one account in the Accounting Equation, there must be a balancing change in another. This concept is known as the Principle of Balance, and is of fundamental importance for understanding GnuCash and other double entry accounting systems. When you work with GnuCash, you will always be concerned with at least 2 accounts, to keep the accounting equation balanced.

Balancing changes (or transfers of money) among accounts are done by debiting one account and simultaneously crediting another. Accounting debits and credits do not mean “decrease” and “increase”. Debits and credits each increase certain types of accounts and decrease others as described in the previous section. In asset and expense accounts, debits increase the balance and credits decrease the balance. In liability, equity and income accounts, credits increase the balance and debits decrease the balance.

In traditional double-entry accounting, the left column in the register is used for debits, while the right column is used for credits. Accountants record increases in asset and expense accounts on the debit (left) side, and they record increases in liability, revenue, and equity accounts on the credit (right) side. GnuCash follows this convention in the register.

Note

This accounting terminology can be confusing to new users, which is why GnuCash allows you to use the common terms Deposit and Withdrawal. If you prefer the formal accounting terms, you can change the account register column headings to use them in the Accounts tab under Preferences (see the GnuCash Help Manual for more information on setting preferences).

Warning

Common use of the words debit and credit does not match how accountants use these words. In common use, credit generally has positive associations; in accounting, credit means affecting the right column of the ledger sheet of an account. This is associated with a decrease in asset and expense, but an increase of income, liability and equity accounts.

For more details see ` <https://en.wikipedia.org/wiki/Debits_and_credits>`__.

Data Entry Concepts¶

When entering data in GnuCash, you should be aware of the 3 levels of organization in which GnuCash divides your data: files, accounts and transactions. These levels are presented in their order of complexity, one file contains many accounts and one account contains many transactions. This division is fundamental to understanding how to use GnuCash.

Files¶

GnuCash stores information at the highest level in files. A file can be stored on your computer either as a single XML file (in all versions of GnuCash), or in a SQL database (in GnuCash version 2.4 and higher).

Note

SQL is pronounced “sequel”, so in spoken and written language we would say “a SQL database”.

With the XML file format, GnuCash stores your data in an XML data file, usually in compressed format (although this can be changed in the General tab of the GnuCash Preferences).

With SQL storage, GnuCash stores your data in a SQL database under the database application you select (SQLite3, MySQL or PostgreSQL).

You will need one main file or database for each set of accounts you are maintaining. To learn how to create and manage GnuCash files, see Storing your financial data.

Note

If you think you might need more than one set of accounts, you might want to consult a professional accountant or bookkeeper before proceeding. Most users will probably have only one data file.

Backup files and log files are automatically generated by GnuCash when appropriate. Backup and log files are described in Backing Up and Recovering Data.

Accounts¶

An account keeps track of what you own, owe, spend or receive. Each GnuCash file can contain any number of accounts, and each account can contain many sub-accounts up to an arbitrary number of levels. This simple feature gives GnuCash much of its power in managing your finances, as you will see in later chapters.

Examples of accounts include: checking accounts, savings accounts, credit card accounts, mortgages, and loans. Each GnuCash account tracks the activity for that “real” account, and can inform you of its status.

In addition, accounts are also used to categorize the money you receive or spend. For example, you can create expense accounts to track the money you pay on utilities or groceries. Even though these are not accounts that receive statements, they allow you to determine how much money is being spent in each of these areas.

Accounts will be covered in more detail in Accounts.

Transactions¶

A transaction represents the movement of money among accounts. Whenever you spend or receive money, or transfer money between accounts, that is a transaction.

Examples of transactions are: paying a phone bill, transferring money from savings to checking, buying a pizza, withdrawing money, and depositing a paycheck. Transactions goes more in depth on how to enter transactions.

In double entry accounting, transactions always involve at least two accounts—a source account and a destination account. GnuCash manages this by inserting a line into the transaction for every account that is affected, and recording the amounts involved in each line. A line within a transaction that records the account and amount of money involved is called a split. A transaction can contain an arbitrary number of splits.

Note

Splits in transactions will be covered in Split Transaction Example

Running GnuCash¶

GnuCash can be run from your desktop main menu by selecting the associated menu entry.

Alternatively it can be run from a command line prompt with the command

gnucash.

During start up, GnuCash will display the Splash Screen, where some information about the program (version number, build, etc.) and the loading process are displayed.

Welcome to GnuCash dialog¶

The very first time you open GnuCash, you will see the Welcome to GnuCash! screen. This dialog includes three choices:

Create a new set of accounts - Runs the New Account Hierarchy Setup assistant (see New Account Hierarchy Setup). Select this option if you want to be assisted in creating a set of accounts.

Import my QIF files - Runs the Import QIF Files assistant (see Import QIF). Select this option if you already have Quicken files (

.qiffiles) and wish to import them into GnuCash.Open the new user tutorial - Opens the GnuCash Tutorial and Concepts Guide. Select this option if you are completely new to GnuCash and accounting concepts.

Note

It is possible to access each of these items after you have left this screen, but the Welcome to GnuCash! screen will not reappear. To create a new set of accounts, see New Account Hierarchy Setup. To import QIF files, see Import QIF.

New Account Hierarchy Setup¶

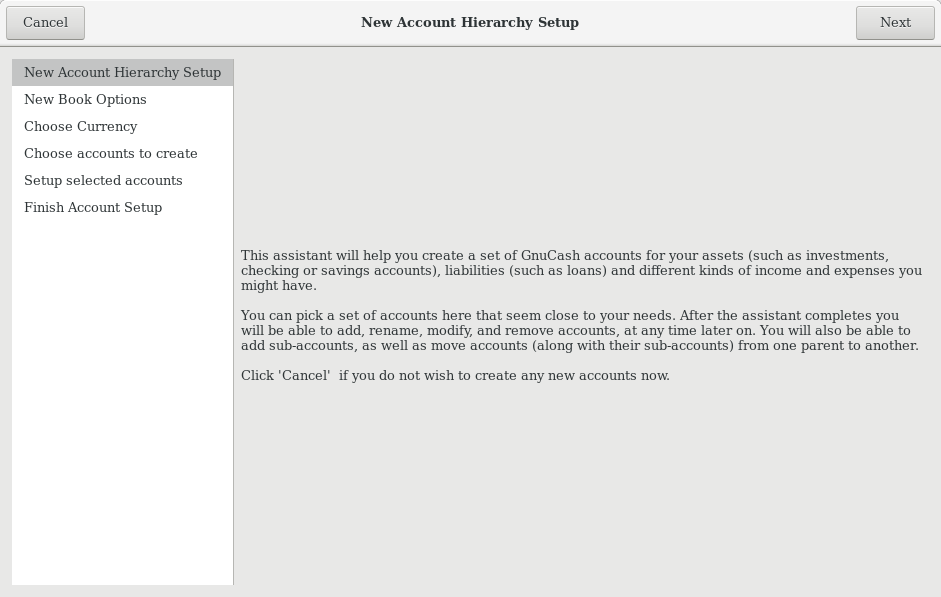

The New Account Hierarchy Setup assistant helps you to create a set of GnuCash accounts. It will appear if you choose Create a new set of accounts in the Welcome to GnuCash! menu, or when you select File > New.

This assistant will create a new blank GnuCash file and guide you through the creation of a Chart of Accounts. There are several steps in the assistant, which are outlined below.

The first screen briefly describes what this assistant does.

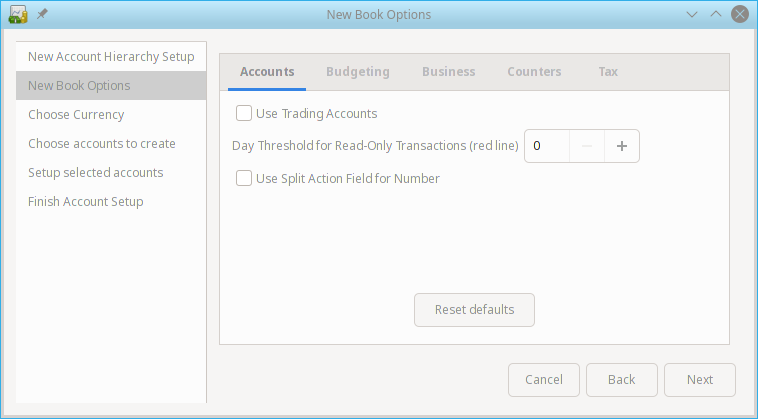

New Book Options allows you to set different attributes for your file that affect the file as a whole. This screen has four tabs: Accounts, Budgeting, Business, and Counters. These items are explained elsewhere in the Guide, and can be changed at a later point.

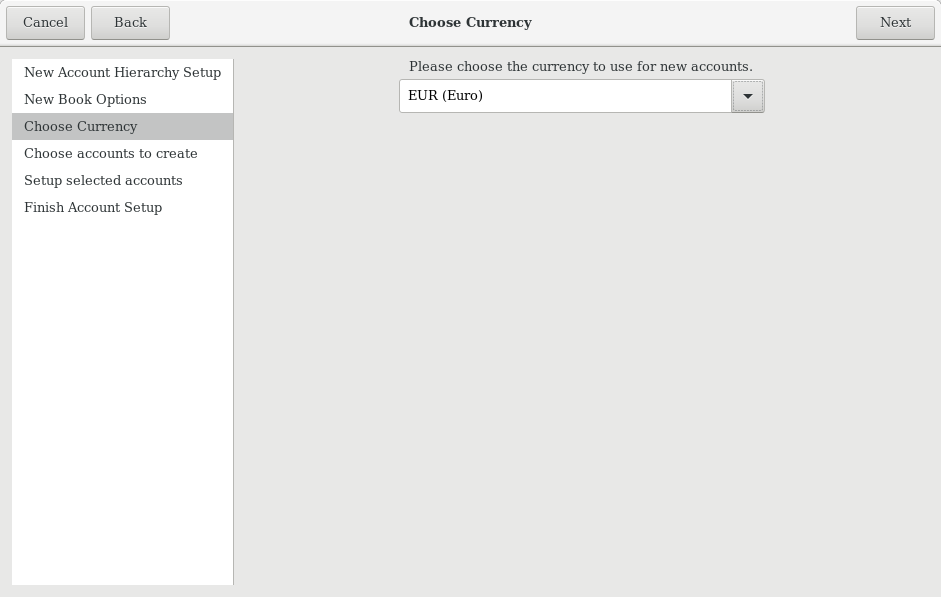

Choose Currency sets the default currency for new accounts. This is based on the computer locale settings, and can be modified later in the Accounts tab under Preferences (see Preferences: Accounts Tab).

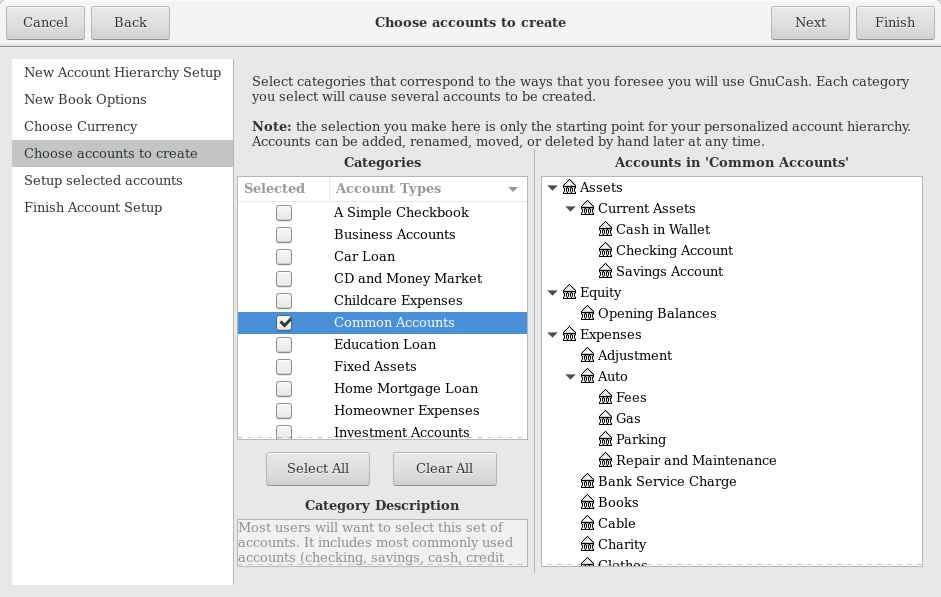

Choose accounts to create allows you to create an initial set of accounts. These can be edited as needed afterward. The screen is divided into three parts.

The left upper portion has a list of Categories for commonly used hierarchies of accounts. Select from this list the types of accounts you wish to use. You can select as many of the categories of accounts as you wish.

The left lower section has a Category Description that displays a detailed description of the category currently highlighted.

The right side has a list of the Accounts that will be created from a selected category. Note that the accounts listed here are only the selected category; your final data file will include all of the accounts for all of the selected Categories.

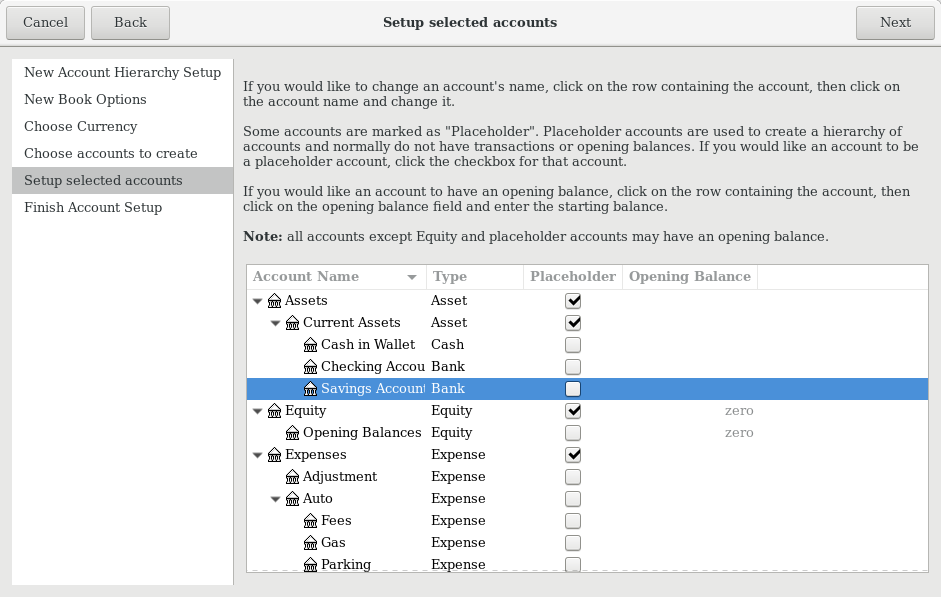

Setup selected accounts lists all the accounts you selected on Choose accounts to create, and allows you to enter opening balances and to designate Placeholder accounts.

Note

Equity accounts do not have opening balances, so the opening balance value for this kind of account is locked and set to zero.

Note

Placeholder accounts are used to create a hierarchy of accounts and normally do not have transactions or opening balances.

The left side of the screen has a list of Account Names. Select an account by “clicking” once in the Account Names column with the account highlighted. This will open the account name for changes.

The right side of the screen has a check-box to make an account a Placeholder and a box to add the Opening Balance for the selected account. Again a single click in the Opening Balance or Placeholder column will open the field for changes.

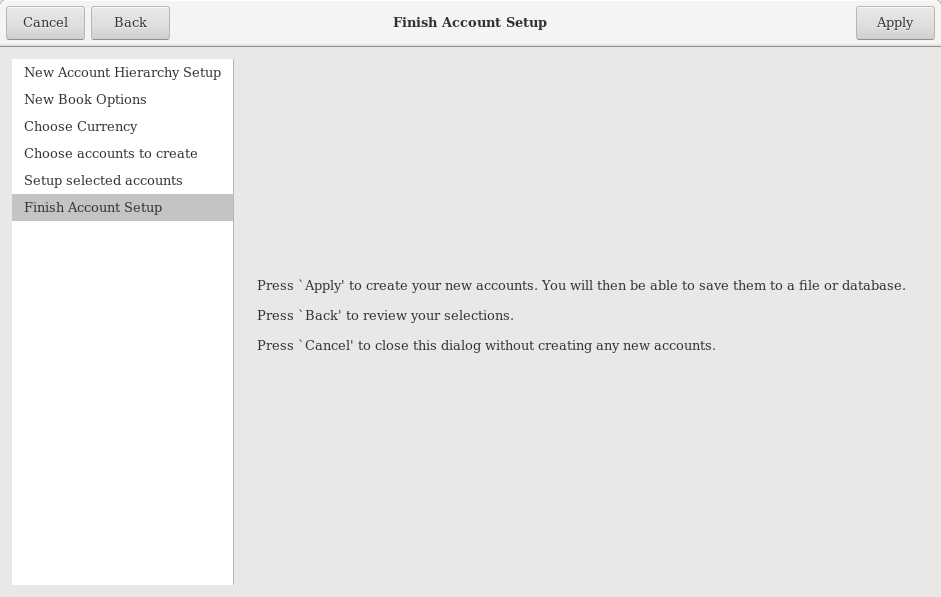

Finish account setup is the last screen and gives you a final option to cancel the process.

Warning

If you choose to cancel, any selections you have made up to this point will be lost.

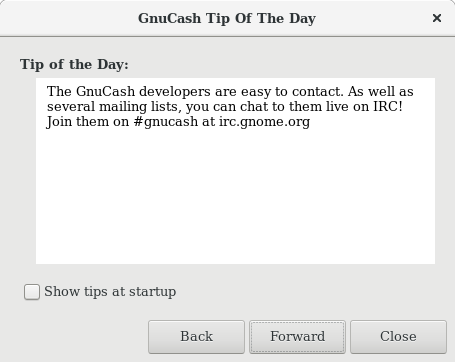

Tip of the Day¶

GnuCash provides a Tip of the Day screen to give helpful hints for using the program:

These tips provide useful information for beginning users. To view more of the tips, click Forward to continue. If you do not wish to see this screen box on start-up, deselect the box next to Show tips at startup. When you have finished viewing the helpful tips, click Close to close the Tip of the Day screen.

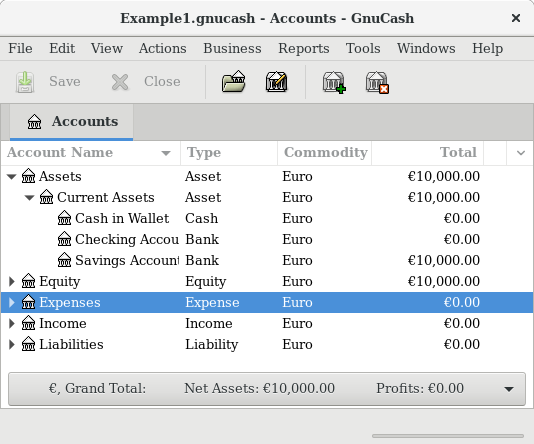

Account Tree Window¶

You should now see the Accounts window, which appears as shown below. The exact layout of the account tree will depend on which default accounts you selected during the New Account Hierarchy Setup. In this example, the Common Accounts are shown.

The Account Tree window (also known as a Chart of Accounts, or CoA) provides an overview of the data contained in the current file. It contains a list of account names and their current balances.

From this window, you can open the register of any account either by double-clicking the account name, right clicking the account name and selecting Open Account from the menu, or by using the Open button on the toolbar. GnuCash allows you to have as many account registers open as you wish. For more information on using account registers, see Account Register Window.

Tip

Clicking the small triangle to the left of an account that has children will expand the tree view showing child accounts.

At the top of this window is the Titlebar, which displays the file name for this set of accounts (once you have saved the file.) Below that is the Menubar. You can access the menu options by either clicking on these menu headings or by using shortcuts and access keys (see Menu Shortcuts). Next is the Toolbar, which contains buttons for the most common functions.

The account tree appears below the Toolbar. Once you have started creating accounts, the account names will appear in the account tree. You can customize which headings show up by using the small down-arrow at the far right just above the account tree.

At the bottom is the Statusbar, which tells you information about what you own (Net Assets) and how much money you have made (Profits).

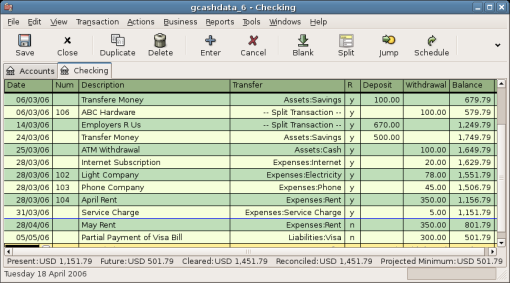

Account Register Window¶

Account Register windows are used to enter and edit your account data. As the name suggests, they look similar to a checkbook register.

Transactions explains more about account register windows and how to enter data into them. For now, note that the parts of an account register window are similar to the parts of the account tree window described earlier. The Titlebar at the top contains the account name. Below that, the Menubar contains menu options related to the account register. Toolbar buttons simplify common data entry functions. The Statusbar at the bottom of the window, displays some account balances covered in Transactions. At the bottom of the account register window, information appears about the current location of the cursor.

Note

In the register windows, you can resize the various columns that GnuCash displays, but keep in mind that the Description and Balance columns behave differently from other columns.

The Description column is designed to expand automatically to fill all unused horizontal screen space. Therefore you should set the widths of all your other columns before setting the Description column width.

The Balance column must be resized by double-clicking on the column heading.

Toolbar Buttons¶

Both the account tree window and the account register window contain Toolbar buttons. These buttons provide quick access to common functions such as Save and Open in the account tree window and Record and Delete in the account register window. If you are not sure what a button does, move the mouse pointer over that button, and you should see a description of the function appear.

Here is a summary of the account tree window buttons:

- Save

Save the current file to disk

- Close

Close the current notebook page

- Open, Edit, New and Delete

These are functions related to accounts. They are discussed in Accounts.

Register-specific buttons are discussed in Transactions.

Tab Bar¶

GnuCash uses a tabbed model that allows you to open multiple account registers and reports simultaneously. Each open window (which can include account registers, reports, or Scheduled Transactions windows) is given a tab on this bar that you can click to view that window. Tabs can be configured in Preferences to appear along any side of the GnuCash window.

To see the full name for a tab, hover the mouse pointer over an account window tab.

If more screens are open than can be displayed across the screen, some tabs will not display. You can move through all tabs by clicking the arrows on either end of the tab bar. A complete list of tabs can be viewed by right-clicking the Tab Bar and any tab can be selected by clicking it.

Storing your financial data¶

Overview¶

GnuCash offers several formats for storing your financial data. The default file storage format is XML, while SQL storage is available in SQLite, MySQL, and PostgreSQL formats. Users can choose a file format for new files from File > Save and for existing files from File > Save As… dialogs.

The XML storage format is a text file that by default is compressed, which is a preference that is set at Edit > Preferences General Compress files. SQLite storage is also available, and stores your data in a single file on your system, like the XML format. However, internally, an SQLite file is managed as a database. The MySQL and PostgreSQL storage options require access to a MySQL or PostgreSQL database server and the installation of additional database drivers on your machine.

Tip

Users can change the format at any time by using File > Save As…. This will create a copy of the data file in the selected format.

Storage Comparison and Recommendations¶

Each storage format has benefits and shortcomings that users should consider for their needs and abilities. See the #basics-storage-comparison-table below for further details.

The XML format is the most stable and established, and for this reason, it is recommended for most users. SQL storage was added for the 2.4 release and has become an increasingly popular choice for users. The SQLite format allows users to realize the benefits of SQL storage without the overhead of installing or managing a full DBMS. MySQL and PostgreSQL require the installation of MySQL and PostgreSQL DBMS, respectively, and are best maintained only by experienced database administrators.

Note

Use of a SQL back end for storage implies to many that GnuCash has fully implemented DBMS features, including multi-user and incremental data manipulation. However, GnuCash does not currently implement these features, although it is a long term goal of the development team.

Storage Comparison Table¶

XML |

SQLite |

MySQL |

PostgreSQL |

|

|---|---|---|---|---|

Availability |

Built-in |

Depends on pa ckaging 5 |

||

File extension |

gnucash |

N/A 6 |

||

Additional software |

None |

MySQL |

PostgreSQL |

|

Additional expertise |

None |

Database A dministrator |

||

Compression |

gzip |

N/A |

||

File Save |

On command |

On commit |

||

Multi-user |

No |

No |

No |

No |

Creating a file¶

To create a new GnuCash file do the following:

From the GnuCash Menubar, choose File > New File. The New Account Hierarchy setup assistant will start.

Note

If you are running GnuCash for the first time, you will be presented with the Welcome to GnuCash! screen. This screen is described in detail in the GnuCash manual.

Set your preferences in the assistant and move through the screens with the Forward, Cancel and Previous buttons.

Saving data¶

Follow these steps to save the file under your preferred name:

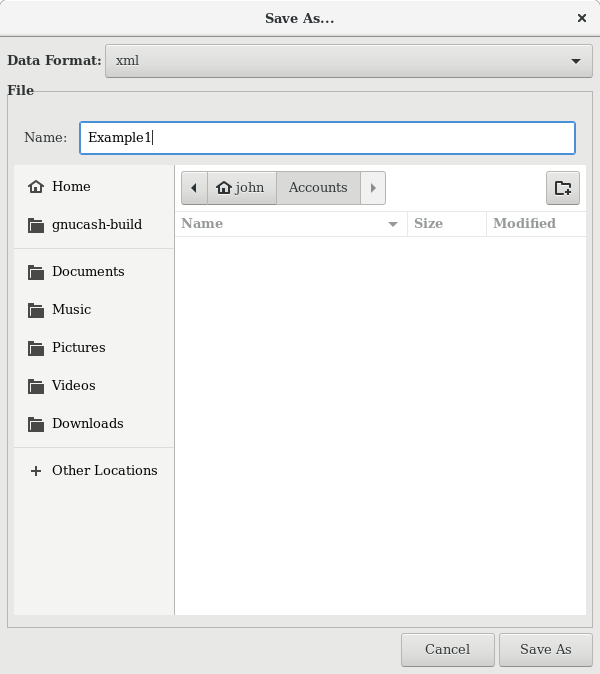

Choose File > Save As… from the Menubar or select the Save Toolbar button. GnuCash will bring up the save window.

Select the Data Format of the file you are saving from the drop down list. The default selection is XML but if you have set up a database back end you can change to that format.

Depending on the selected Data Format the window can change as described in the following.

If you selected XML or sqlite3 you will see a screen like this:

Save screen when XML or sqlite3 is selected.¶

Type your chosen filename in the Name field. It is not necessary to specify an extension when you write the file name. GnuCash will automatically add the extension

.gnucashto the file.Note

The

.gnucashextension was introduced in the 2.3 series of GnuCash. For already existing files, the extension will never be changed. So if you open an existing file namedMyoldfile, that name won’t be changed if the file is saved. You might use the Save As… command and give the file a new name in order to have it saved with the extension.gnucash.Select the path where the file will be saved by browsing the tree in the lower panes.

Tip

Click on the Create Folder button to create a new folder with a custom name in the selected path.

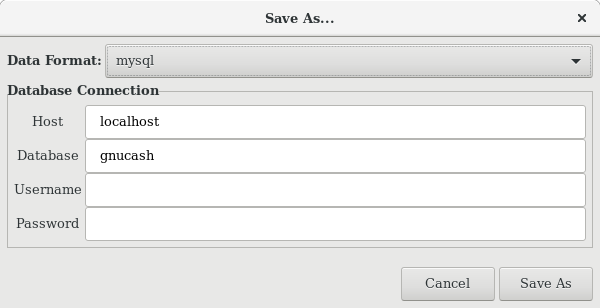

If you selected mysql or postgres Data Format you will see a screen like this:

Save screen when mysql or postgres is selected.¶

Enter in this window the Database Connection information: Host, Database, Username and Password.

Warning

Saving to mysql or postgres requires the proper permissions in that database, that is you need to have the permissions to create a new database with the given database name, or you need to have write access to an existing database with the given database name.

Click the Save As button to save the file.

If you are keeping track of finances for a single household, you need only one file. But if you are also tracking business finances or want to keep data separate for some reason, then you will need more than one file.

Before ending each GnuCash session, be sure to save your data changes using File > Save or the Save Toolbar button.

Note

As it is very important to save your data frequently to avoid losing them for whatever reason, GnuCash is able to automatically save the opened file every a certain amount of time. This interval can be set in the General tab under Edit > Preferences (GnuCash > Preferences on MacOS). Keep in mind that this option is relevant only if you are saving in XML format. If you are working with a database, the Save button and the Save menu entry will be grayed out because changes are stored right away.

Opening data¶

To open an existing file or database, select File > Open from the menu. In the window that will open, select the Data Format. If you selected File choose the file you want to open by browsing the folders in the lower panes. Else, enter the required Database Connection information.

Tip

GnuCash keeps a list of the recently opened files. Open the File menu and you will see listed the names of recently opened files. Click on the one you want to load to open it.

Duplicating an Account Hierarchy¶

In some cases, it might be useful to duplicate the structure of an existing data file in a new file. For example, you might want to try out new accounting techniques without corrupting your actual accounting data, or you might need to follow accounting guidelines that require you to close your books at the end of the year and begin each year with a fresh set of books.

GnuCash allows you to create an empty copy of your Chart of Accounts simply by selecting File > Export > Export Accounts. When you select this command, you are asked to provide the name for the new empty file, and GnuCash creates a new data file that contains only your account hierarchy (that is, there is no transaction data). Once saved, the new file can be opened like any other GnuCash data file as described above.

Backing Up and Recovering Data¶

GnuCash creates several types of files to help ensure that your data is

not lost. If you look in the folder where your saved file resides, you

may see other files generated by GnuCash with the following extensions:

.gnucash, .log, .LCK, .LNK in the same directory as your

primary data file. What each of these files does is presented below.

Note

The following sections are relevant only if you are saving your financial data in the XML format

$ ls

myfile.gnucash

myfile.gnucash.20100414185747.gnucash

myfile.gnucash.20100414223248.log

myfile.gnucash.20100415114340.gnucash

myfile.gnucash.20100415154508.log

myfile.gnucash.20100415173322.gnucash

myfile.gnucash.20100415194251.log

myfile.gnucash.7f0982.12093.LNK

myfile.gnucash.LCK

Backup file (.gnucash)¶

Each time you save your data file, a backup copy will also be saved with

the extension .YYYYMMDDHHMMSS.gnucash. This backup file is a

complete copy of your previous data file, and the filename format refers

to the data file, year, month, day and time of the backup. For example,

the filename myfile.gnucash.20100414185747.gnucash indicates this is

a backup copy of the file myfile saved in the year 2010, April 14,

at 6:57:47 p.m.

To restore an old backup file, simply open the

.YYYYMMDDHHMMSS.gnucash file with the date to which you wish to

return. Be sure to save this file under a different name.

Note

.YYYYMMDDHHMMSS.xac instead of the actual extension

.YYYYMMDDHHMMSS.gnucash. So if you upgrade from the 2.2 series to

the 2.4 series, you may end up with both .YYYYMMDDHHMMSS.xac and

.YYYYMMDDHHMMSS.gnucash backup files in your directory.

Log file (.log)¶

Each time you open and edit a file in GnuCash, GnuCash creates a log

file of changes you have made to your data file. The log file uses a

similar naming format as the backup files: .YYYYMMDDHHMMSS.log. Log

files are not a full backup of your data file - they simply record

changes you have made to the data file in the current GnuCash session.

In case you exit GnuCash inadvertently, possibly due to a power outage or a system wide crash, it is possible to recover most of your work since the last time you saved your GnuCash file using this log file. This is the procedure:

Open the last saved GnuCash file.

Go to File > Import > Replay GnuCash .log file and select the one .log file with the same date as the saved file you just opened. Make sure that you picked the right .log file, or you will possibly wreak havoc in your accounts.

Log replaying will recover any transaction affecting the balance entered since the last save, including those created from scheduled transactions and business features (invoices, bills, etc.).

Warning

Changes to the scheduled transactions, invoices or bills themselves are NOT recovered, and their transactions that were recovered may not be properly associated with them, and should thus be double-checked. Especially for business transactions, you may have to delete and re-create some of them. If you do not, although the balance will be correct, some reports may not.

Lock files (.LNK and .LCK)¶

You may occasionally see .LNK and .LCK files appear. These do

not store any data, but they are created to prevent more than one user

from opening the same file at the same time. These files are

automatically created when you open the file, to lock it so no one else

can access it. When you close your GnuCash session or open another file,

GnuCash unlocks the first data file by deleting the .LCK and

.LNK files.

If GnuCash crashes while you have a data file open, the .LCK and

.LNK files are not deleted. The next time you try to open GnuCash,

you will get a warning message that the file is locked. The warning

message appears because the .LNK and .LCK files are still in

your directory. It is safe to choose Yes to open the file, but you

should delete the .LNK and .LCK files (using a terminal window

or your file manager). Once those files are deleted, you will not get

the warning message again unless GnuCash crashes.

File Management¶

So which files should you keep around? Keep your main data file, of

course. It’s a good idea to keep some of the more recent

.YYYYMMDDHHMMSS.gnucash backup files, but you can safely delete the

.log files since they are not complete copies of your data.

Note

If you upgraded from a GnuCash version prior to 2.4, you may also

have backup files in the old .xac format. For these files you can

apply the same principle described above for

.YYYYMMDDHHMMSS.gnucash backup files.

You should also delete any .LCK and .LNK files that you see

after closing GnuCash. If you decide to back up your data file to

another disk manually, it’s enough to back up the main data file - not

the .YYYYMMDDHHMMSS.gnucash backup files.

Note

By default GnuCash will automatically delete any .log and

.YYYYMMDDHHMMSS.gnucash backup files that are older than 30 days.

You can change this behavior in the GnuCash preferences in the

General tab under Edit > Preferences (GnuCash > Preferences on

MacOS).

Migrating GnuCash data¶

Sometimes you may need to move your financial data and GnuCash settings to another machine. Typical use cases are when you buy a new computer or if you want to use the same settings over two different operating systems in a dual boot configuration.

Migrating financial data¶

Migrating GnuCash financial data is a as simple as copying .gnucash

files with a file manager if you know where they are saved. If you can’t

remember where a file is stored but you can open it directly within

GnuCash, save it in the desired path from within GnuCash.

All other files in the folder are either backups or log files. It won’t do any harm to copy them too, but it’s not likely to do any good, either.

Migrating preferences data¶

Preferences are stored in three different locations: one for GnuCash preferences, one for reports, and one for online banking settings. Preferences are managed by gsettings, reports are managed by GnuCash itself, and online banking is managed by aqbanking. If you do not use online banking, then you will not have this folder on your machine.

Where the GnuCash preferences are stored varies depending on your operating system (see table_title, table_title, and table_title). To back up and transfer your entire installation, you must copy these preferences as well.

Operating system |

folder |

|---|---|

Unix |

GnuCash preferences are stored in dconf. You can

use the commands |

Mac OSX |

|

Windows |

The preferences are stored in the Windows

registry

|

Operating system |

folder |

|---|---|

Unix |

|

Mac OSX |

|

Windows |

|

Operating system |

folder |

|---|---|

Unix |

|

Mac OSX |

|

Windows |

|

Note

On Unix and Mac OSX, these folders will generally not display in the file manager. You must set the file manager to show hidden files and folders to see them.

Tip

On Unix and Mac OSX, the ~ symbol means the home folder.

Putting It All Together¶

Note

This section begins a tutorial that will continue throughout this book. At the end of each chapter, you will see a Putting It All Together section that walks you through examples to illustrate concepts discussed in that section. Each Putting It All Together section builds on the previous one, so be sure to save your file for easy access.

Let’s get started!

First, let’s create a file to store your real data. Open GnuCash and select File > New File from the Menubar. This will start the New Account Hierarchy Setup assistant that allows you to create several accounts at once.

Note

If you are running GnuCash for the first time, you will be presented with the Cannot find default values screen which is described in details in the GnuCash manual.

New Account Hierarchy Setup: Introduction¶

The first screen of the assistant gives you a description of what the assistant does. Click the Forward button to proceed to the next screen.

In the second screen, set the New Book Options on the different tabs, then press the Forward button. You can also update these options later using File > Properties. For details of these options, see the GnuCash Help manual, chapter Customizing GnuCash, Book Options.

New Account Hierarchy Setup: Book Options¶

In the third screen, select the currency to use for the new accounts from the dropdown list. Then press the Forward button.

Note

The currency you select here, will be assigned to all the accounts created in this assistant.

New Account Hierarchy Setup: Currency Selection¶

In the fourth screen select the Common Accounts group in the Categories pane. Then press the Forward button to proceed.

Note

If you want, you can select one or more of the predefined account-groups here. For more information on account types, see GnuCash Accounts.

New Account Hierarchy Setup: Account Selection¶

In the fifth screen you will be able to set an Opening Balance on each of the accounts, as well as indicate if the account should be a Placeholder. As these features will be described in next chapters, leave all as configured by GnuCash and click Forward to open the last screen of the assistant.

New Account Hierarchy Setup: Account Setup¶

In the last screen of the assistant, click Apply to create all the accounts and leave the assistant.

New Account Hierarchy Setup: Finish¶

After pressing Apply in the previous window, you will be presented with the save dialog. Select the XML Data Format, Name the file as

gcashdata_1, select the folder where to save the file (remember it as the data file will be used in the tutorials throughout this manual), and finally press the Save as button.Your main window should now look something like this:

Tutorial: Starting Account View of the Test File¶

- 1

SQLite relies on an additional package and driver (called libdbi and libdbd-sqlite3, respectively), which are installed by default on Mac OS and Windows. Linux users may need to manually install these for SQLite.

MySQL and PostgreSQL may require the installation of additional software drivers (libdbd-mysql and libdbd-pgsql).

- 2

MySQL and PostgreSQL place data within their own storage system.

- 3

SQLite relies on an additional package and driver (called libdbi and libdbd-sqlite3, respectively), which are installed by default on Mac OS and Windows. Linux users may need to manually install these for SQLite.

MySQL and PostgreSQL may require the installation of additional software drivers (libdbd-mysql and libdbd-pgsql).

- 4

MySQL and PostgreSQL place data within their own storage system.

- 5

SQLite relies on an additional package and driver (called libdbi and libdbd-sqlite3, respectively), which are installed by default on Mac OS and Windows. Linux users may need to manually install these for SQLite.

MySQL and PostgreSQL may require the installation of additional software drivers (libdbd-mysql and libdbd-pgsql).

- 6

MySQL and PostgreSQL place data within their own storage system.

- 7

Up to GnuCash 2.6.21 it was

~/.gnucash/- 8

Up to GnuCash 2.6.21 it was

~/.gnucash/- 9

Up to GnuCash 2.6.21 it was

~/.gnucash/